Major causes of deforestation in Southeast Asia include unsustainable production of agricultural and forest commodities, and infrastructure development. Aside from producers, buyers, consumers and government, the financial sector is one of the most powerful actors to stimulate sustainable commodity production as well as infrastructure development through its financial leverage and capital allocation decisions.

The integration of sustainability principles in publicly listed companies’ disclosures, and in banks’ strategies, products, and corporate governance and risk management frameworks, will contribute towards better understanding of opportunities from low-carbon development while mitigating systemic risks from climate change.

To reduce negative impacts and contribute to long-term sustainability of the banking sector, the project supports the development of:

- E&S policies by financial regulators;

- E&S safeguards are in place in target countries’ financial institutions;

- green financial products;

Key milestones:

- Co-organized biannual sustainable dialogue fora with the Bankers Association of the Philippines since 2018

- Engaged financial institutions and regulators on climate and environmental risk mapping methodology and sustainable finance framework tool

- Supported policy development, i.e. 2020 BSP sustainable finance framework, and 2019 PSE-SEC sustainability reporting guidelines for publicly listed companies

- Conducted CEO Breakfast Forum with board members of banks to communicate BSP expectations on BSP Circular 1085

- Convened academe, training institutions, and standard setting bodies to harmonize standards in sustainability reporting for banks

- Organized webinar series for local and regional banks

- Published annual sustainable banking assessment report for Philippine banks using SUSBA, an online interactive tool

- Published assessment of regulations on ESG integration by banks in the ASEAN region

WWF-Philippines Talks About Tackling ESG Risks through Finance, for a Sustainable Future

The financial sector stands poised to address the risks that threaten it, and the rest of society.

WWF Network Discusses the Future of Sustainable Finance in the Face of Climate Change

Experts from the World Wide Fund for Nature (WWF) and the United Nations Environment

WWF-Philippines, Banking Sector Call for Harmonization in Push for Sustainable Finance

The World Wide Fund for Nature (WWF) Philippines and the Bankers Association of the Philippines (BAP)/p>

From New Normal To Better Normal: What's In It For Banks?

The framework for a better normal, enabled by sustainable finance, has been laid down./p>

Songwriting for Swans: Green Finance for A New, Better Normal

The COVID-19 pandemic is the black – some would say, green – swan event of the 21st /p>

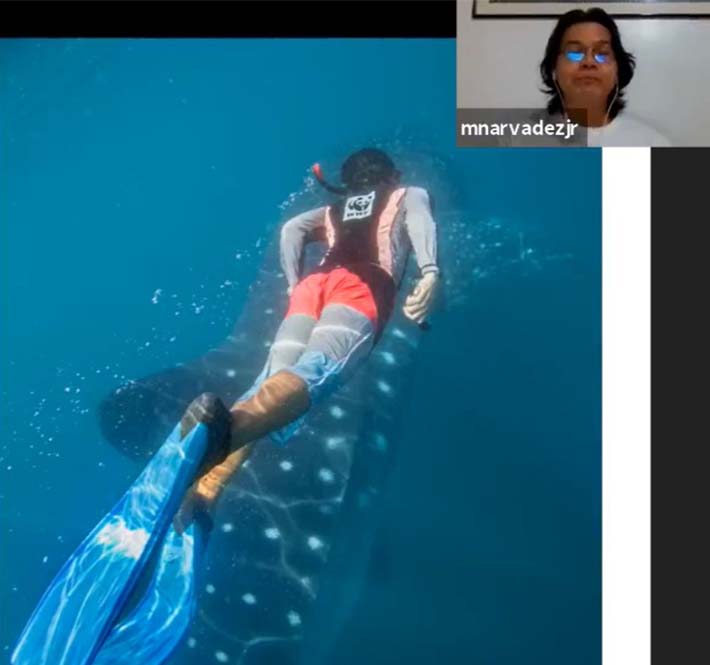

Panda Talks continue to shed light on conservation this May!

Faithful to its aim of equipping the Filipino people with knowledge on key environmental issues/p>

Philippine Banks and Sustainable Business

In keeping with the 1.5°C global warming cap and achieving the targets of the United Nations Sustainable Development Goals (SDG),

ASEAN Banks Need to Better Manage Climate Risks

A new WWF report finds ASEAN’s biggest banks are increasingly aware of the impact that their businesses have on the environment

Two PH Insurance Orgs In Global Pact

Two Philippine organizations are part of the largest collaborative initiative

The "Taking Deforestation out of Banking Portfolios in Emerging Markets" Project is part of the International Climate Initiative (IKI). The Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety (BMU) supports this initiative on the basis of a decision adopted by the German Bundestag.